Key Metal Exports Restricted, Prices Soar

Advertisements

In a world increasingly defined by globalization, the interconnectedness of national economies has grown unprecedentedly. As countries navigate through external pressures and unfair sanctions, many have found it necessary to take protective measures to safeguard their national interests. Recently, China's imposition of export restrictions on crucial minerals such as gallium, germanium, and antimony has triggered a ripple effect in international markets, creating significant challenges for Western nations, including the United States. This move not only responds to the ongoing sanctions imposed by the U.S. against China but also signals the escalation of what some might refer to as a silent war over the periodic table of elements.

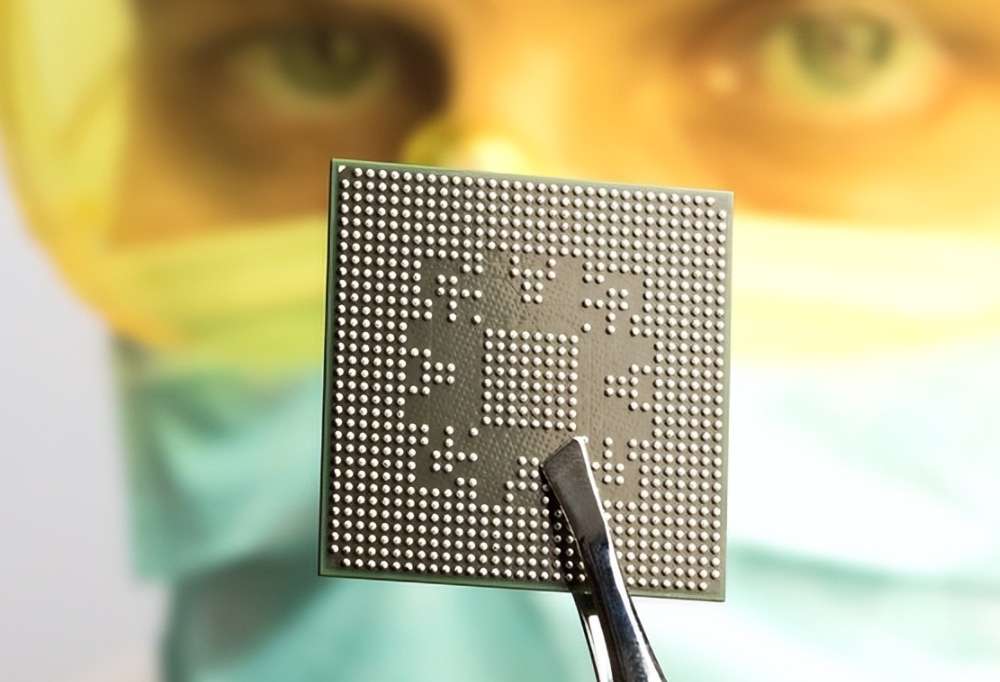

Gallium stands out as a metal with immense importance in high-tech industries. This rare element plays an irreplaceable role in a range of applications, from semiconductor materials to solar cells and even advanced military equipment. The global distribution of gallium is starkly uneven; statistically, in 2021, the world produced merely 430 tons of gallium, with China accounting for a staggering 420 tons—about 97.67%. Furthermore, China's gallium reserves are the largest in the world, totaling 190,000 tons, representing 68% of the global total.

In contrast, while the U.S. has a relatively rich supply of gallium, its reserves are a modest 4,500 tons and the domestic production infrastructure lacks maturity. Gallium is not simply extracted like traditional minerals; it requires an intricate refining process for extraction. This complexity, coupled with the absence of a robust supply chain, makes it nearly impossible for the U.S. to ramp up large-scale production. American media has indicated that it could take at least 15 years for the U.S. to re-establish a gallium supply chain, effectively placing it at the mercy of China’s resources in the short term.

Since China enacted its export restrictions, prices for gallium on the global market have soared. This escalation in costs not only burdens the U.S. with increased procurement expenses but also poses a considerable threat to its advanced weaponry and semiconductor industries. Given gallium's critical role in these sectors, any limitations in supply could directly undermine the technological and military prowess of the United States.

Germanium, another pivotal metal, is instrumental in fiber optic communications, solar cells, and infrared optics. Similar to gallium, China boasts a dominant position in the germanium market, holding 41% of global reserves and producing 70% of worldwide output. Despite possessing ample germanium resources, the U.S. has not yet tapped any of its domestic germanium mines.

The recent restrictions placed on germanium exports by China have caused further upheaval in the global market. Recent data indicate that from January to October 2024, China’s gallium exports decreased by nearly half compared to the same period the previous year, and germanium export levels took a significant hit as well. This drastic reduction has led to a demand-supply imbalance in the market, causing prices to spike dramatically.

For the United States, restricted access to germanium represents an additional weakening of its competitive stance in high-tech industries and military capabilities. As with gallium, the applications for germanium are widespread and crucial; any disruption in its supply chain could have immediate repercussions on U.S. scientific research, development, and production capabilities.

Antimony, distinct from gallium and germanium, has a more evenly divided global distribution, but China still leads in both production and reserves, accounting for 80% of global output and possessing 400,000 tons, which constitutes one-third of the global total. Even though the U.S. ranks as one of the few nations capable of large-scale antimony production, its supplier base is limited, especially since it relies heavily on a single company.

Chinese restrictions on antimony exports have led to a significant market reaction, with prices soaring by as much as 230%. This spike increases costs for the U.S. while posing substantial challenges in related sectors. The applications of antimony are similarly varied and vital, being crucial in flame retardants, batteries, and semiconductor chips. Any limitations on supply could have serious implications for product quality and competitive standing in the market.

Beyond gallium, germanium, and antimony, trade relations and resource management come into sharper focus in the face of geopolitical tensions. China's ability to control the supply of these vital minerals does not just affect its immediate economic interests but signifies a broader shift in power dynamics as nations reassess their resource strategies. As the world’s leading producer of rare earth elements, China wields a significant amount of leverage. Rare earths are essential not only for technology but also for defense, making China’s potential decision to limit rare earth exports have wide-reaching, deleterious effects on global markets and industry.

For the U.S., the implications of such control represent an even graver challenge. The reliance on rare earth elements in advanced weaponry and semiconductor production underscores how deeply intertwined these resources are with national security. The restriction of rare earth supplies could threaten not just current U.S. technological and military competencies but could also reshape the future international competitive landscape.

The escalating tensions surrounding export restrictions lead us to contemplate intricate questions regarding the fragility of global economic ties in a landscape where nations are prompted to act on their national interests. In the face of external pressures and perceived injustices from sanctions, countries often feel the imperative to protect themselves through various means. Yet, this begs the question: how can nations foster resilient collaboration while also safeguarding their vital interests?

This confrontation lays bare a harsh lesson for the United States, urging a reconsideration of its approaches to foreign relations. It emphasizes the importance of respecting the sovereign rights and interests of other nations, dissuading them from pursuing stringent sanction measures that could provoke retaliatory behaviors. Moreover, it serves as a reminder for the U.S. to bolster its own industrial capabilities and innovative capacities to prepare for similar situations in the future.

Leave A Reply